--- Table of Contents ---

10/23/2016 Please take a look at our latest flier. It contains the majority of arguments in a two page format. Click the following link for the flier in PDF downloadable format bit.do/noGGflier

You can also click the following two images to just view the flier here.

9/21/2016 EDIT: East Bay Times agrees with us VOTE NO ON MEASURE GG

Looking for volunteers! Please e-mail me at thenewarkrhetorician@gmail.com

You can also click the following two images to just view the flier here.

9/21/2016 EDIT: East Bay Times agrees with us VOTE NO ON MEASURE GG

Looking for volunteers! Please e-mail me at thenewarkrhetorician@gmail.com

Isn’t this ballot measure going to fund enhanced police services and anti-drug programs?

Isn’t the current library cramped and inefficient?

Does the library have any historical significance?

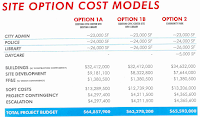

Isn’t renovating our current structures much more costly? Why is the City asking for so much money if it only needs half?

What are affordable alternatives?

Why should I care about a regressive sales tax? Isn’t it better than a property tax?

Isn’t it urgent to replace the Civic Center to protect the safety of Newark residents?

Won’t there be an oversight committee checking spending?

The City says you are just expressing your opinion; why should I not believe the study completed by an independent consultant?

All images and other materials are available at this link:

Onedrive Link to Materials

If you would like a copy of the Newark Days flier, it is available here:

--- Introduction ---

Since September 2015, we, Newark residents, have been closely watching the process to study the replacement of the Newark City Library, Administration Building and Police Headquarters. The following images are the City’s and Our Initial Arguments, as well as rebuttals from both the City and Ourselves. You will want to read those first.

As Newark residents we all want what is best for City Staff, but that is not an excuse to ignore the best long-term interests of those paying for this $126 million measure: Newark taxpayers. I hope you will join us and other Newark residents in voting “NO” on Measure GG on November 4, 2016. We deserve better from our elected officials. One of the few powers we have as residents is at the ballot box. Do not waste our opportunity to get a better deal by supporting a deeply problematic proposal.